What Shaped the Industry This Year and What Leaders Must Learn From It

A comprehensive review of the events, technologies, and strategic shifts that defined eCommerce in 2025 and how they are reshaping digital commerce moving forward.

Planning for What Comes Next

2025 did not reward brands that chased trends blindly. It rewarded those that paused, assessed their foundations, and invested in scalable, resilient growth. If you are evaluating where your eCommerce strategy stands today, this is the right moment to step back and reassess.

Introduction: Why 2025 Was a Defining Year for eCommerce

If 2024 was about uncertainty and recalibration, 2025 became the year of clarity. The eCommerce industry moved decisively away from hype driven decisions and into an era defined by operational discipline, strategic maturity, and measurable outcomes.

The biggest shift was not a single technology or platform. It was a mindset change across leadership teams. Growth was no longer judged by traffic alone. Conversion quality, margin protection, operational efficiency, and system resilience became the true markers of success.

This year forced companies to answer uncomfortable questions. Are we over investing in tools we do not fully use. Are our platforms scalable or just expensive. Are our teams working harder instead of smarter.

From AI powered shopping experiences to social commerce acceleration, from logistics pressure to rising acquisition costs, 2025 reshaped how eCommerce businesses operate at every level.

This industry review breaks down the most influential events and trends that shaped eCommerce in 2025 and what decision makers should take forward.

Artificial Intelligence Became Infrastructure Not Innovation

AI stopped being a differentiator and became a baseline expectation.

Artificial intelligence was present in eCommerce before 2025. What changed this year was how deeply it embedded itself into everyday commerce operations.

AI moved out of pilot programs and into production environments. Retailers no longer asked if they should use AI. They asked where AI would create the fastest return.

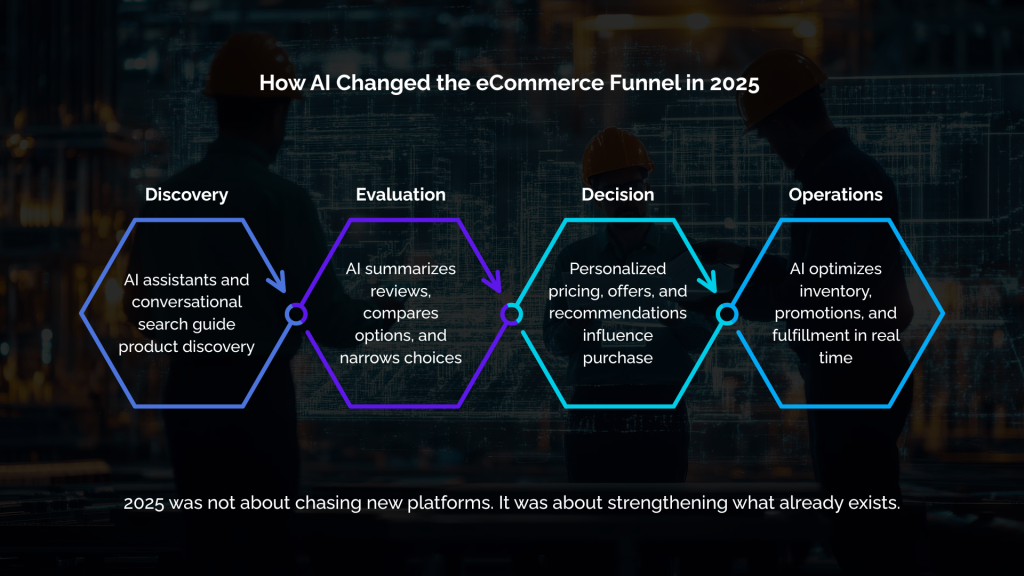

AI Driven Discovery Changed How Customers Find Products

One of the most significant shifts in 2025 was how customers discovered products.

Traditional search driven journeys began to erode as AI assistants and conversational interfaces gained traction. Customers increasingly relied on AI tools to research products, compare options, summarize reviews, and even initiate purchases.

This created a new challenge for brands. Visibility was no longer only about ranking on search engines. It was about being understood, structured, and trusted by AI systems.

Product data accuracy, structured content, and authoritative brand signals became critical. Brands with poor product information or fragmented data struggled to surface in AI driven recommendations.

AI Personalization Reached Operational Maturity

Personalization in 2025 was no longer limited to product recommendations. AI systems actively influenced pricing strategies, inventory allocation, promotional timing, and customer communication.

Successful retailers used AI to reduce manual decision making. Failed implementations occurred where AI was layered on top of broken processes.

The key lesson from 2025 was clear. AI amplified whatever foundation already existed. Strong systems became stronger. Weak systems became more visible.

Social Commerce Shifted From Experiment to Revenue Channel

Social platforms stopped being awareness tools and became full commerce ecosystems.

In 2025, social commerce finally matured in Western markets.

Live shopping, influencer led storefronts, and native checkout experiences gained legitimacy beyond early adopters. Platforms like TikTok and Instagram refined their commerce offerings, improving logistics integration, creator monetization, and buyer trust.

Livestream Shopping Found Its Audience

Livestream commerce succeeded in 2025 because it stopped trying to replicate television shopping.

Instead, it leaned into authenticity, community, and real time interaction. Smaller creators, niche brands, and specialized product categories performed better than mass market campaigns.

The winning formula combined entertainment, education, and immediacy. Brands that treated livestreams as scripted sales events underperformed. Those that treated them as interactive conversations built loyalty and repeat customers.

Brand Control Became a Competitive Advantage

Despite the growth of social commerce, many brands learned an important lesson. Owning the customer relationship still mattered.

Marketplaces and social platforms delivered reach, but they did not guarantee retention. Brands that invested in direct to consumer infrastructure alongside social commerce achieved stronger lifetime value.

Social platforms became acquisition layers. Brand owned experiences became profit engines.

Logistics and Fulfillment Became Strategic Boardroom Topics

Delivery speed and reliability became as important as price.

By 2025, logistics was no longer an operational afterthought. It was a core competitive differentiator.

Consumers expected fast delivery, flexible fulfillment options, and transparent tracking. At the same time, rising shipping costs and labor constraints pressured margins.

Unified Commerce Models Gained Momentum

Retailers began consolidating inventory, order management, and fulfillment systems into unified commerce architectures.

This allowed them to fulfill orders from warehouses, stores, and third party locations dynamically. The result was improved delivery speed and reduced fulfillment costs.

Brands that continued operating siloed systems struggled to meet expectations during peak periods.

In House Logistics Became More Common

Large eCommerce players increasingly moved logistics in house to gain control over customer experience and costs.

This shift disrupted third party logistics providers and forced mid market brands to reevaluate outsourcing strategies.

The takeaway from 2025 was not that every brand should own logistics. It was that logistics decisions must align with growth strategy, not convenience.

Consumer Behavior Continued Its Permanent Shift

The post pandemic customer is no longer evolving. They have arrived.

By 2025, digital first behavior was fully normalized across demographics.

Consumers expected seamless mobile experiences, instant information, flexible payment options, and consistent service across channels.

Convenience Became the Primary Value Proposition

Price sensitivity remained, but convenience often outweighed discounts.

Customers chose brands that reduced friction. Faster checkout, clearer product information, predictable delivery, and easy returns mattered more than aggressive promotions.

Brands that optimized for experience retained customers even during economic uncertainty.

Trust and Transparency Influenced Buying Decisions

Data privacy, ethical sourcing, and brand credibility became more influential in 2025.

Customers paid attention to how brands handled data, communicated policies, and responded to issues. Trust was no longer a marketing claim. It was an operational outcome.

Security and Platform Resilience Took Center Stage

Downtime and breaches became unacceptable risks.

With traffic peaks spreading across longer promotional periods, platform reliability became mission critical.

Cyber attacks, bot traffic, and infrastructure failures increased in frequency and sophistication during 2025.

Security Became a Growth Enabler

Brands that invested in security and performance infrastructure experienced smoother peak periods and stronger conversion rates.

Security was no longer framed as risk mitigation. It was framed as revenue protection.

Platform Decisions Became CFO Level Conversations

Total cost of ownership gained attention in 2025.

Leadership teams evaluated platforms not only on features but on long term operating costs, scalability, and integration complexity.

This shifted the conversation away from frequent replatforming toward optimization of existing ecosystems.

Are Your Systems Ready for the Next Phase of Growth

Many of the challenges exposed in 2025 were not caused by market conditions. They were caused by outdated architecture, disconnected tools, and reactive decision making. Understanding your current gaps is the first step toward sustainable growth.

Sustainability Became a Business Expectation Not a Brand Statement

Sustainability moved from messaging to measurable action.

In 2025, sustainability expectations shifted from aspirational goals to operational requirements.

Consumers expected transparency in sourcing, packaging, and logistics. Regulators increased scrutiny. Investors evaluated sustainability as part of long term risk management.

Operational Efficiency Supported Sustainability Goals

Brands that optimized logistics, reduced returns, and improved forecasting achieved sustainability gains alongside cost reductions.

Sustainability and profitability aligned more clearly than in previous years.

Greenwashing Lost Effectiveness

Consumers became more informed and skeptical.

Superficial sustainability claims without data or proof damaged trust. Brands that communicated honestly, even about limitations, earned credibility.

What 2025 Taught eCommerce Leaders

The year rewarded discipline over disruption.

Several lessons stood out clearly by the end of 2025.

First, technology alone does not create advantage. Execution does.

Second, customer experience is built by systems working together, not isolated features.

Third, growth without operational clarity increases risk.

Finally, eCommerce success increasingly depends on cross functional alignment between marketing, operations, finance, and technology.

How Leaders Should Prepare for What Comes Next

The future belongs to businesses that optimize before they expand.

Moving forward, the most successful eCommerce organizations will focus on strengthening foundations before chasing new channels.

They will invest in data quality, system integration, and process automation. They will evaluate technology decisions through a total cost lens. They will treat customer trust as a measurable asset.

2025 made one thing clear. Sustainable growth is intentional, not accidental.

Build for What Comes After 2025

The lessons of 2025 provide a blueprint for smarter, more resilient eCommerce growth. Whether you are stabilizing operations, scaling globally, or improving profitability, the next step should be informed, strategic, and grounded in reality.

FAQs

What was the biggest eCommerce trend in 2025

Artificial intelligence becoming embedded into core commerce operations rather than being used as an experimental tool.

Did social commerce outperform traditional eCommerce in 2025

Social commerce grew rapidly, but the strongest results came from brands that combined social acquisition with owned digital experiences.

Why did logistics matter more in 2025

Customer expectations around delivery speed and reliability increased while costs rose, making logistics a strategic differentiator.

Are customers more price sensitive in 2025

Customers remained price aware, but convenience, trust, and experience often outweighed discounts.

Is replatforming still necessary for growth

In many cases, optimizing existing platforms delivered better results than replatforming, especially when total cost and disruption were considered.